Is It Too Late to Join the Shared Power Bank Market?

Shenzhen Woshi Industrial Development Co., Ltd. Analyzes Market Realities

With over 3.8 million Shared Power Bank units now deployed across the world, many businesses question whether this market remains viable. Let's take China market for exmaple, Shenzhen Woshi Industrial Development Co., Ltd. shares data-driven insights into current opportunities and risks for new entrants:

1. Market Saturation vs. Growth Potential

While tier-1 cities show 89% equipment density in commercial areas, national statistics reveal:

62% of county-level cities still lack dedicated Charging Stations

Tourist zones experience 4.7x higher demand than residential areas

New equipment installations grew 23% YoY in 2023 despite overall market maturity

"Saturation exists in specific segments, but underserved markets still offer 300-500% ROI potential," states industry researcher Liu Fang.

2. Competition Dynamics

Current market leaders focus on:

High-traffic locations (airports, CBDs) with 98% occupancy rates

Premium-priced 24-hour rental services (¥15-30 per use)

Branded co-branded solutions with telecom operators

However, niche opportunities emerge in:

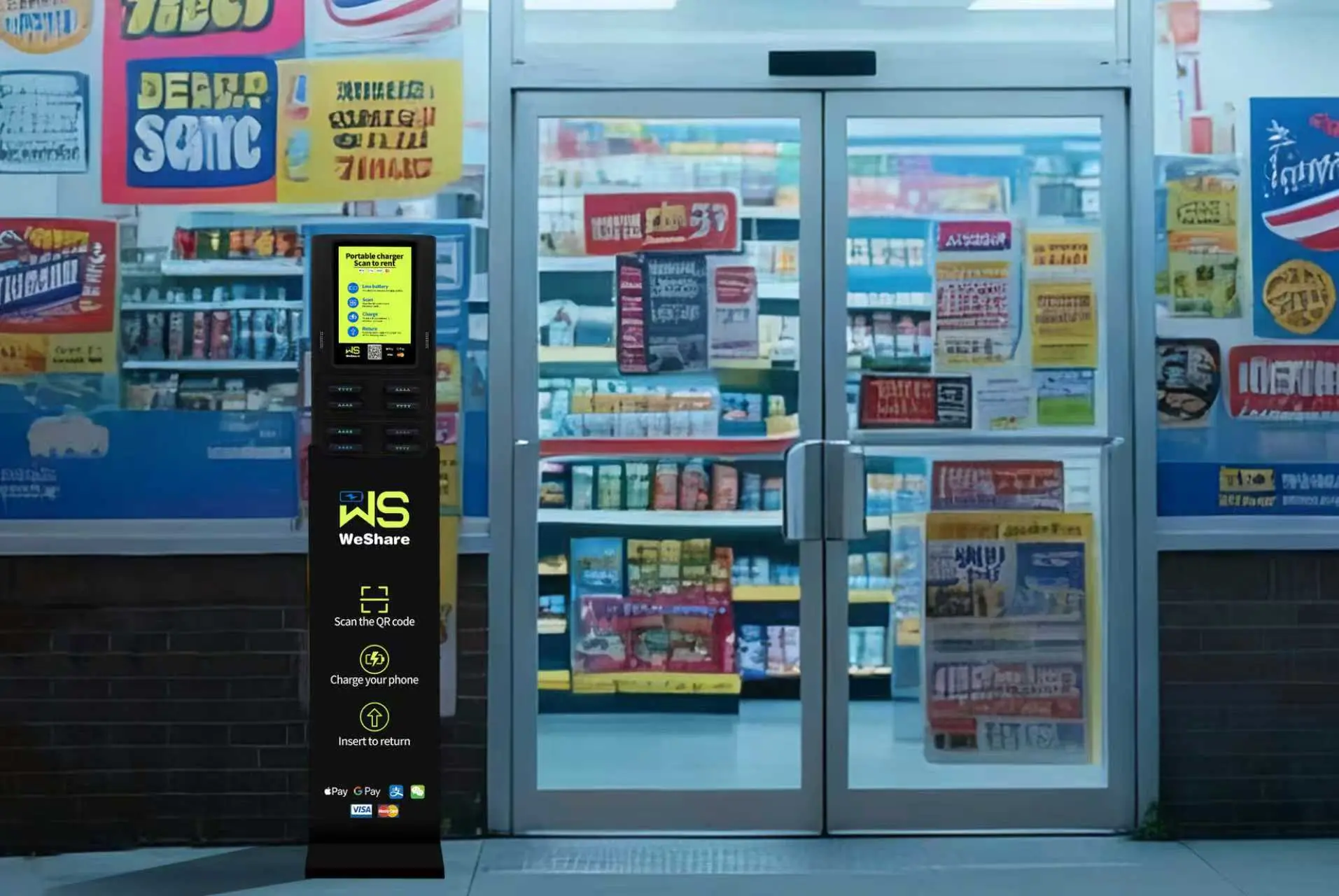

Community supermarkets (68% lower competition intensity)

Industrial parks (daily usage peaks at 11am/6pm)

Medical waiting areas (zero competing devices)

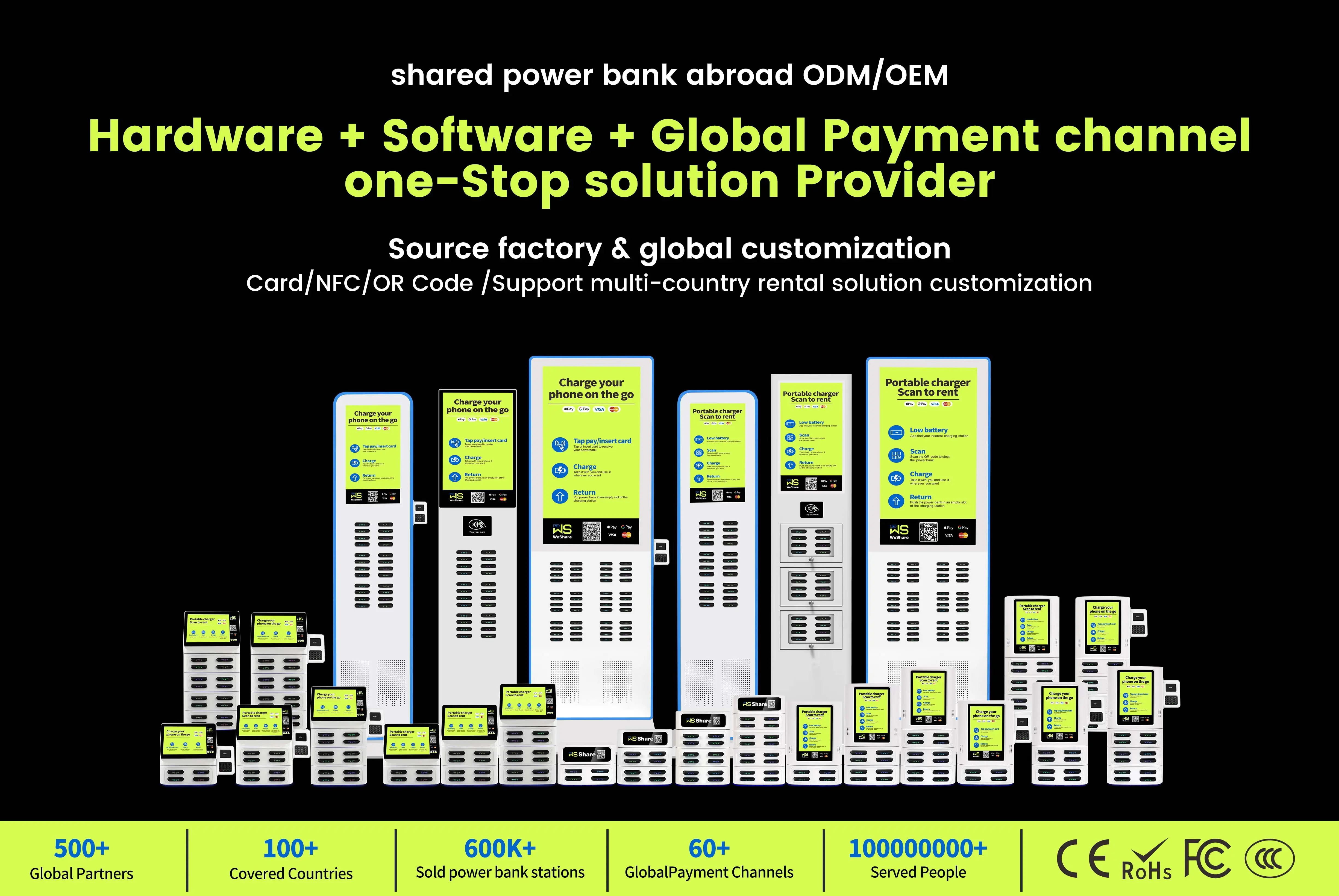

3. Entry Barrier Reduction

Modern solutions require 72% less upfront investment than 2019 models:

Battery costs dropped 41% due to standardized components

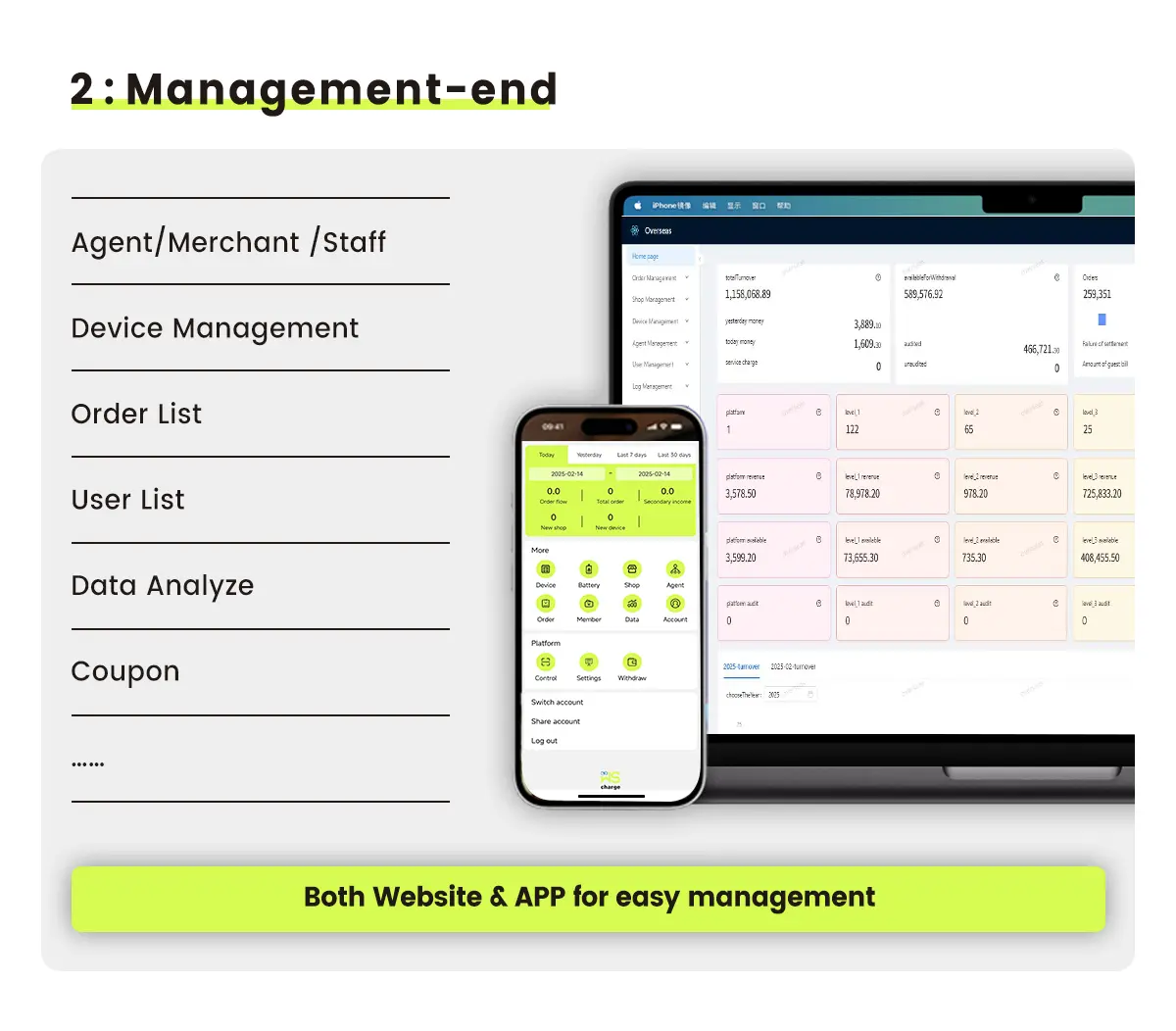

Cloud management platforms eliminate IT infrastructure needs

Maintenance labor reduced to 2 hours/week via remote diagnostics

Case study: A Chengdu convenience store chain added 15 units in 2023, achieving 94% occupancy rates with ¥900/month/unit revenue – 2.1x higher than older equipment in similar locations.

4. Risk Mitigation Strategies

Shenzhen Woshi recommends:

Prioritize locations with <50% equipment density

Use modular units allowing future function upgrades

Partner with property managers for revenue-sharing agreements

"Market maturity actually reduces risk through stable demand patterns," explains commercial director Zhou Wei. "New entrants in secondary cities report 14-month payback periods, versus 19 months for early-stage deployments."

WS Kate

WS Kate Weshare Power Bank

Weshare Power Bank